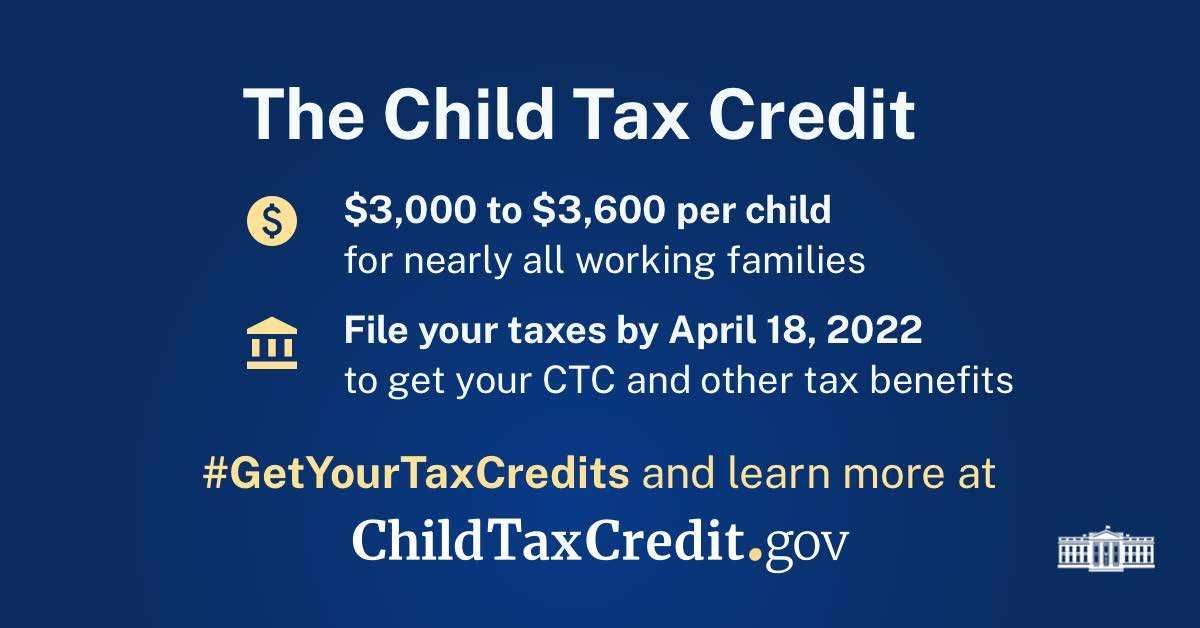

The Child Tax Credit is a large tax refund payment that people can receive when they file a tax return. The 2021 American Rescue Plan expanded who can receive these payments and increased the amount of money available to many families.

• Parents can receive $3,000 or $3,600 per child ages 0-17 depending on the child’s age.

• Income eligibility: All eligible families can receive the full credit if they make less than

$150,000 for a married couple or $112,500 for a single parent in 2021.

• File your taxes to get your remaining credit or your full credit if you haven’t gotten

monthly payments: Families, including those who received part of their Child Tax Credit as

monthly payments last year, can get their remaining Child Tax Credit by filing a tax return this

year. If you did not receive monthly Child Tax Credit payments, you will receive the full credit

amount when you file your tax returns.

• Non-taxable: The Child Tax Credit, including the monthly payments received last year, is a tax

cut. It is not income that will be taxed.

• Does not affect other federal benefits: Receiving the Child Tax Credit will have no impact on

anyone’s eligibility for, or lower the amount of, other federal benefits.

• For parents and legal guardians: Anyone, including grandparents, who are legal guardians

may be eligible for the Child Tax Credit.

Volunteer Income Tax Assistance (VITA) programs help workers with limited income keep more of their hard-earned money by providing free tax prep services. To find a VITA location near you, check out the IRS VITA Locator here.

To work with an online VITA program or do your taxes (for free!) online, go to GetYourRefund.org.